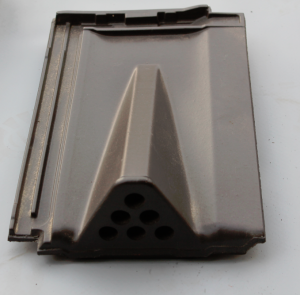

Taška větrací Stodo hnědá engoba

Taška větrací Stodo hnědá engoba 6 ks

Cena 50 Kč 1ks

Komentáře

Přehled komentářů

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - SEARCHING FOR LOST BITCOIN WALLETS

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - BITCOIN LOTTERY - SOFTWARE FREE

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

CharlesAcrow - How to Stream Games Using Limelight: A Beginner's Guide to Seamless Streaming

Romance and Lovers of Stream!

Welcome to Limelight Stream https://limelight-stream.com – your ultimate destination for seamless and high-quality streaming entertainment. Whether you’re a movie enthusiast, a TV series binge-watcher, or a fan of live events, Limelight Stream offers an unparalleled experience tailored to meet all your viewing needs. Dive into a diverse collection of movies, TV shows, documentaries, and exclusive content available only on Limelight Stream. Enjoy crisp, clear, and uninterrupted streaming in HD, making every viewing experience memorable.

Game streaming software features

Limelight graphics quality

Game streaming software updates

Limelight user manual

Stream games on the go

Good luck!

Lamaheece - BITCOIN CRACKING SOFTWARE

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - BITCOIN CRACKING SOFTWARE

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

ArthurSuh - Transunion Says I’m Deceased

Mistakenly Identified as Deceased by TransUnion: An Increasing Concern

Inaccuracies in credit reporting can have very detrimental consequences. One of the most alarming mistakes people may experience is having their credit bureaus, such as **TransUnion**, mistakenly report them as dead. This grave error can have a substantial detrimental impact on everything from employment opportunities to credit applications. It is essential in such cases to know how to dispute a background check and to navigate the complications of credit report disputes.

### Understanding the Problem

Imagine learning you are mistakenly listed as deceased on your credit record. This is not an uncommon issue, however. Individuals in this situation must act swiftly to fix it. One crucial first step can be to contact a background check lawyer or a deceased on credit report lawyer. Specialists in background check errors, these experts can provide the assistance you need to fix your credit report.

How to Contest a Background Check

Being aware of how to dispute a background check becomes critical when faced with such a major mistake. Reach out to the credit bureau that made the error first. You must confirm your ID and show you are still alive. Utilizing marked as deceased on credit report lawyers can accelerate this sometimes daunting process. These professionals can ensure your case is addressed properly and walk you through the complications of a background check dispute.

The Role of Attorneys in Resolving Credit Report Errors

Particularly valuable is working with my credit report says I'm deceased lawyers. These legal professionals concentrate in identifying and resolving severe mistakes on credit reports. They can advocate for you in interactions with credit bureaus and other concerned parties to guarantee your problem is handled and fixed promptly. Considering their expertise in background check disputes, they are well-versed with the legal avenues open to fix such errors and can provide strong counsel if needed.

Preventing Future Errors

Once the error is resolved, steps must be taken to prevent it from reoccurring. Frequently inspecting for errors in your credit report can help find problems early on. Active credit monitoring and knowing how to dispute a background check can help protect against potential mistakes. Should inconsistencies arise, acting swiftly to **dispute a background check** can reduce the effect of these errors on your individual and economic life.

In conclusion, it can be upsetting when TransUnion reports you as deceased. However, with the right method and support from experienced professionals like a background check lawyer, individuals can navigate the journey of contesting these errors and restoring their creditworthiness.

Learn more: https://bucceri-pincus.com/emily-islada-cus/

Lamaheece - BITCOIN MONEY SEARCH SOFTWARE

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - SEARCHING FOR LOST BITCOIN WALLETS

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - BITCOIN CRACKING SOFTWARE

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - BITCOIN LOTTERY - SOFTWARE FREE

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - SEARCHING FOR LOST BITCOIN WALLETS

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - BITCOIN CRACKING SOFTWARE

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Lamaheece - BITCOIN LOTTERY - SOFTWARE FREE

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141

Lamaheece - BTC PROFIT SEARCH AND MINING PHRASES